How To Grow Existing Business Revenues & Keep Your Customers Happy – Using CRM

John Cheney, the CEO at Workbooks recently hosted part 2 in our CRM for sales series. This session focused on Account Management. We have compiled the key takeaways below.

1. The importance of Customer Success

The more happy your customers feel towards your organisation, the more likely they are to continue buying from you.

So how can we ensure your customers aren’t angry red but are happy green?

Using the three pillars of customer success:

-

- Customer Services – ensure you have a good customer service structure with the tools and services to underpin it

-

- Proactive Account Management – having the right tools in place to be proactive in keeping your customers happy

-

- Cross / Up Selling – targeting and selling, growing your footprint in a particular account

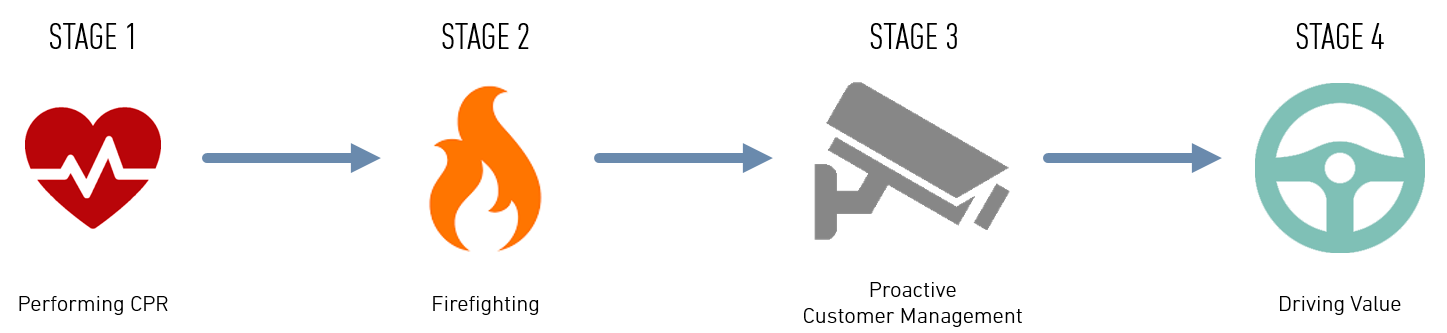

Account Management – Maturity

Once you’ve become familiar with the three pillars of customer success you can move onto identifing where you are on your account management lifecycle – are you trying to get to know your customers or do you already have a proactive account management strategy in place? So where do you sit on this chart?

2. Account management framework

Now you know which stage you are at, we recommend you look to build a framework. Start by:

-

- Defining how best to manage your customers – most organisations have far more customers than account managers so you must balance your resources against your risk/reward level.

-

- Roll out a common language across your organisation – for example everyone at your organisation should understand what a Tier 1 customer or an ‘at risk customer’ means.

-

- Implement Best Practice – think about and define how you want to manage your customers. Eg. If it’s meeting face to face every month, then roll this out across all your Tier 1 customers. By defining and documenting these processes you can much more effectively train new staff.

-

- Measurements – once you’ve defined the above it’s crucial to measure these over time and adjust to maximise return.

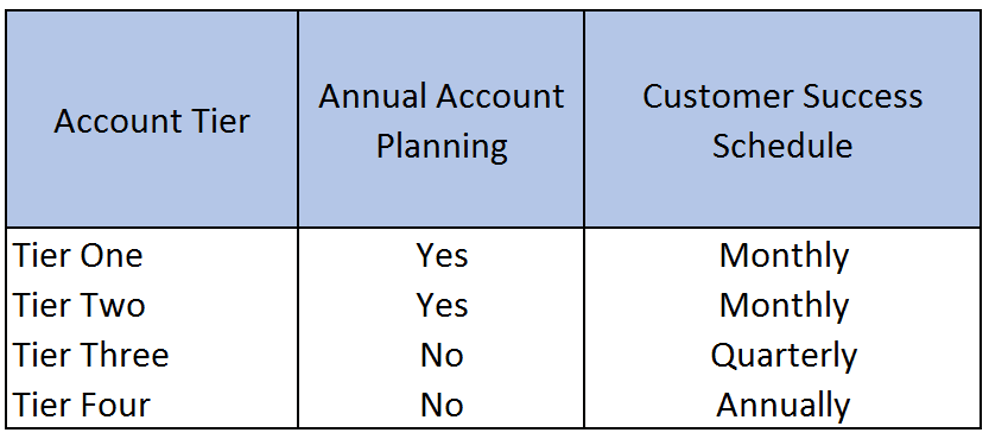

Profiling your customers

You need to leverage your resources to get the most value and key to this is profiling your customers.

We recommend tiering your customers into different bands and depending on the band providing additional levels of resource.

When tiering your customers we recommend you use at least 2 metrics, for example annual spend and potential annual spend.

Embedding into your CRM process

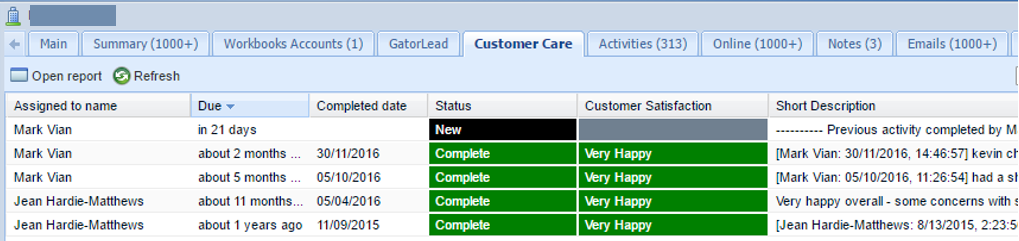

Now your customers have been profiled, you should plan out your account management process. We recommend you do not overcomplicate at the beginning. CRM is a journey so you can evolve over time but start with simple and clearly define steps.

Once a process is created you can bed these into your CRM platform. As an example on the right hand side you can see Customer Care Calls for the Month split by Tier.

Or further below you can see an example of previous customer care activities on an organisation record, this is great for Account Managers as it gives them a good overview ahead of picking up the phone.

Managing risk

We all want happy customers but we all know they’re not all happy all of the time. If we can acknowledge their problems and show empathy we can move them to a resolution and get our relationship back on track.

We suggest you begin with:

-

- Implementing an organisational wide ‘unhappy customer’ process

-

- Empower your staff to put any customer ‘at risk’ (make this simple & train all staff – not just customer service & sales)

-

- Measure & improve over time – use Case records or Activities to track actions and plans

3. Actionable insights

Now we have the information in our CRM we can begin to pull out actionable insights, for example changes in buying behavior.

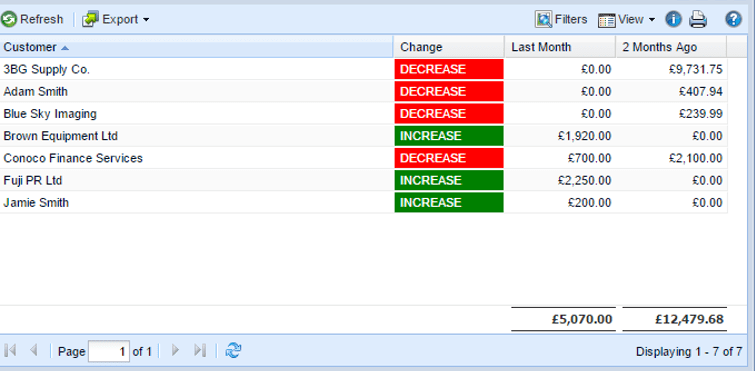

On the right hand side image we can see 4 of our customers have reduced their spend in the last three months. At this point you may want to understand why these customers aren’t buying – has some other supplier come in or has their business slowed?

By analysing this information and using management alerts you can drive effective account management follow-up and be pro-active in dealing with any arising issues.

Using the same approach to upselling

By using Order/Invoice information you can uncover opportunities, for example you could add a field against each product offering with a drop-down on whether the organisation has the potential to buy that software and then run a report to pull all organisations who have the potential to buy but have yet to purchase. Once this is done, you can then run a campaign.

Link to an online web presence

Using Workbooks CRM, you can see in real time which customers are live on your website and what they’re looking at – categorising pages in different ways.

So for example if an exisiting customer is then looking at a product page they’ve yet to purchase, you can use this information to create an opportunity.

Risk management in practice

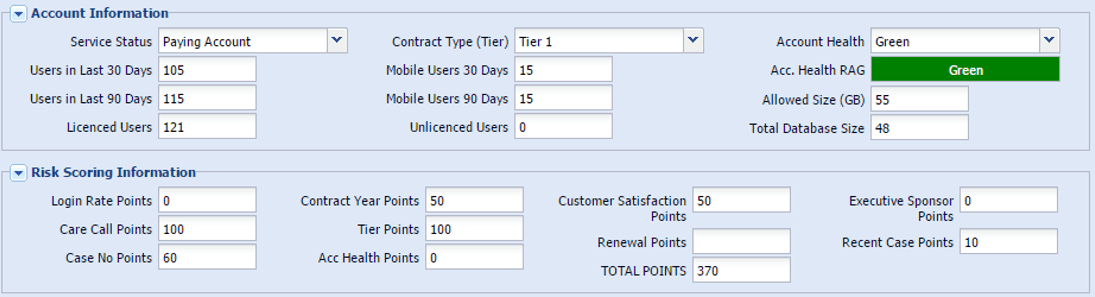

Below is a screen-shot from one of our organisation records where we have a ‘Risk Scoring Information’ section.

We are rating the organisation against a number of different factors: for example you can see 115 users have logged in the last 90 days from an account of 121 users, this is a good ratio so we’ve given them a login rate point of 0. However customer call points is 100 – this is due to not having a customer care call recently. Considering a few more factors, this organisation has a total of 370 points. You may set a criteria that says that if the organisation goes over 500, then it automatically goes into ‘At risk”, which would drive a review of the account to see if any corrective actions were required.

Renewals

Any subscription business – maintenance, membership etc should be driving renewals from CRM.

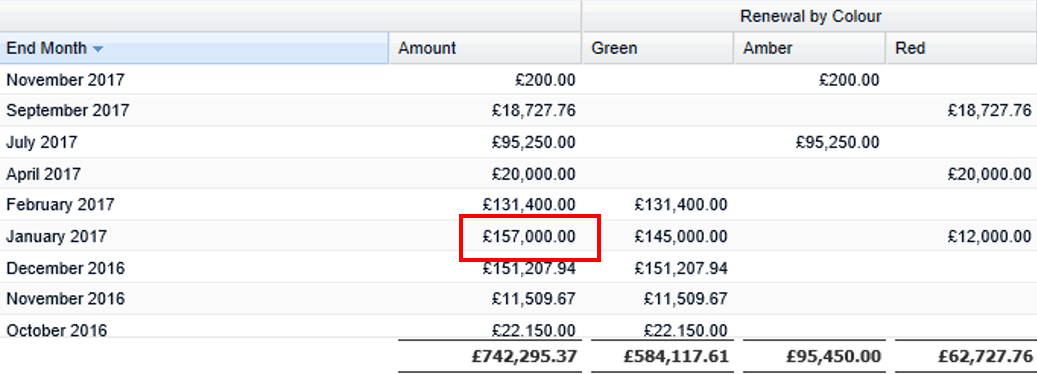

This becomes very powerful when linked with the previous concepts we’ve spoken about. As an example, on the right-hand side we can see our renewals by month and colour. We can spot at-risk Amber and Red accounts which are due for a renewal well ahead of time and drive more resource to get them back on track.

Summary

It is important to have a proactive account management process: profiling customers, deciding on investment per customer and having a defined process. This will result in happier customers and a higher ability to drive more revenue.

Actionable insights – such as spotting changes in customer behaviour, upselling opportunities, renewal management, website integration and proactive risk management – can drive behaviour that yield greater return and help you and your team make better decisions.

We hope this webinar has given you ideas on how you can drive greater value for your customers and reap the reward of a account management efforts.